Why do houses fall out of contract? It’s a question we get a lot from our sellers. There are many things you can do to assure a successful transaction. But first, sellers need to understand why buyers back out of a contract.

Houses may fall out of contract at any time, even close to closing. This is why home selling deserves a great amount of planning and focus. After inspection, many contracts need a property appraisal. Typically, lenders won’t finance a home for more than the appraised value. If the appraisal comes in short, the seller will have to agree to a lower sales price or the buyer will pay for the difference. It’s common for contracts to have an addendum. This allows a buyer to back out of the deal if the appraisal comes in short and a new agreement can’t be made. When faced with a low appraisal, it’s best to review the options. Sometimes, a seller may be able to contest an appraisal if an agent is able to show comparable properties that sold for a higher price. In the end, it will be up to the appraiser if they feel the need to adjust their valuation.

The Inspection Reveals Expensive or Unexpected Repairs

When an offer is accepted, a buyer usually has a week to conduct an inspection. They may ask for certain areas to be fixed prior to the sale or for the seller to reduce the price to cover the cost of the repairs. Some common items that inspectors flag are issues with grout or tile, tears in the carpet, or countertops. Home inspectors also check roofing, cooling, and heating systems, as well as the electrical and plumbing of the house. A trusted Real Estate agent can guide sellers on particular requirements and common practices of home selling. It’s always best for sellers to get an appraisal before listing their property so issues can be fixed beforehand. This will also sellers to prepare a concession to offer in the contract.

The Buyer’s Financing Falls Through at the Last Minute

After the inspection and appraisal, the buyer should have sufficient information about the home to feel confident in their purchase. There also are fewer options that allow them to back out without losing their earnest money, this reassures sellers the buyer is serious about the deal. But when a buyer’s financing falls through, it can still impede a contract. Some contracts do have addendums to protect the buyer from unexpected events that may hinder loan qualification such as a job loss. While there are some scenarios a buyer won’t be able to foresee, having as much of the loan process completed prior to putting in an offer can help set up fewer complications during the transaction.

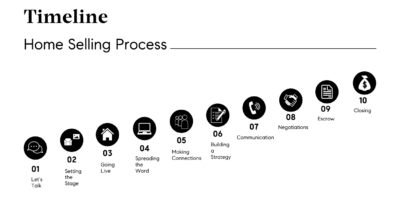

Ultimately, the best thing you can do for yourself during the home-selling process is to lean on your Real Estate agent. Real Estate agents help buyers and sellers to be better prepared for a smoother closing. The best Realtors® will be there for you every step of the home-selling process.

Why Sell Your Home with the Minchen Team?

Working with our in-house marketing and advertising agency, the Minchen Team will target the right audience across the most effective channels. Our cohesive brand identity will elevate the style and story of your home. Fewer days on market mean more value for you. Backed by a data-driven strategy, Compass listings spend less time on the market than the industry average.