People who can afford to live in San Francisco are decreasing due to high prices.

Who can still afford to live in San Francisco? San Francisco is one of the most affluent city in the U.S. Residents who own their own home are further from the income necessary to live comfortably. Even a six-figure income is less than half what you need to own your home and still spend only half your income on necessities in SF. With that being said, San Francisco housing market is thriving. Less popular neighborhoods like Richmond, Sunset and West Portal are becoming sought after. People afford to live in San Francisco have a job that pays mortgage and allow them to enjoy the abundant parks, restaurants and many other amenities.

Cost of Living

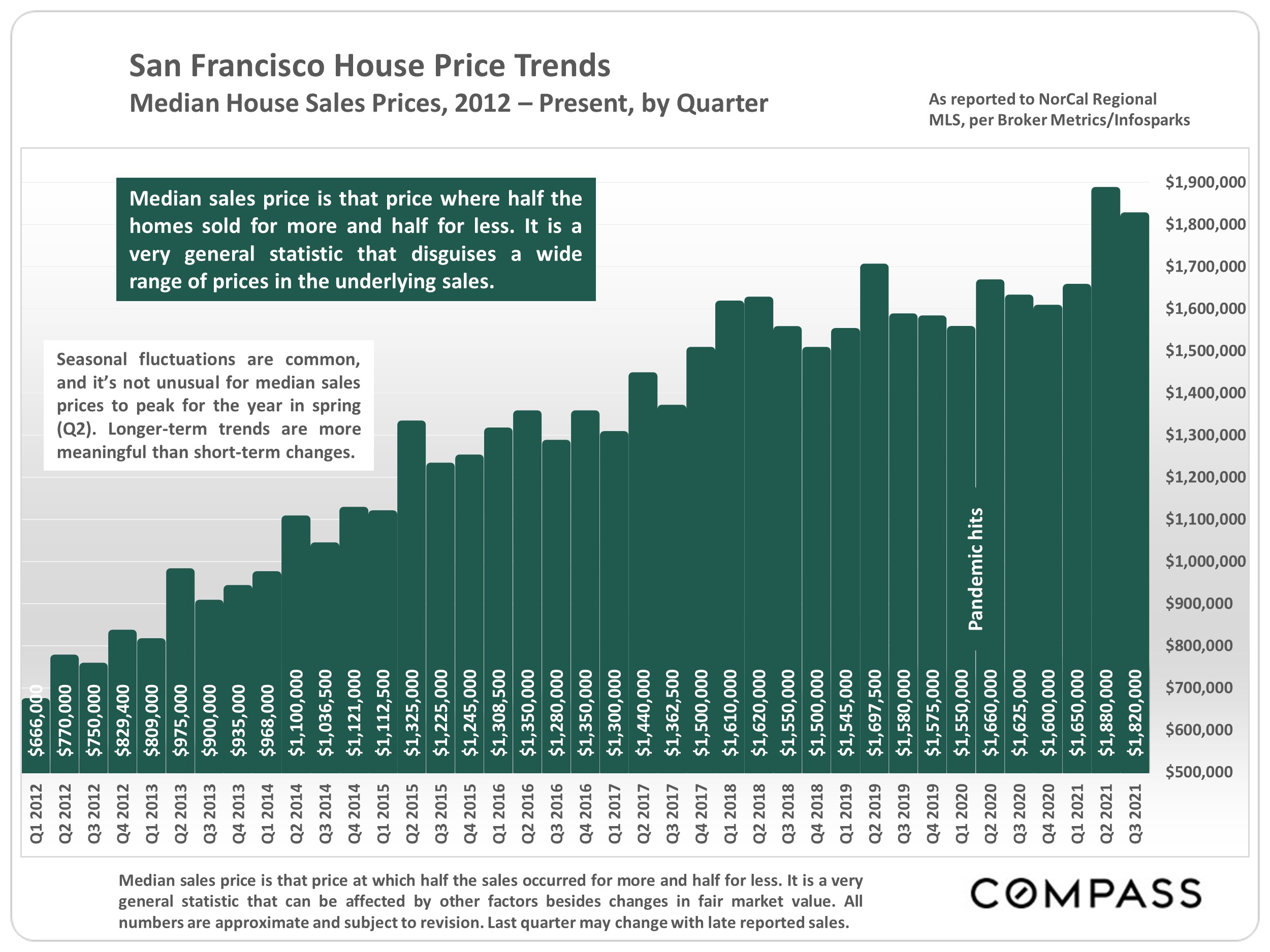

San Francisco is a beautiful city. However, there’s no getting around the fact that it is expensive to live here. Even before the pandemic, it is already considered an expensive city. The high density of the population drives up home prices. Hence, rental prices are higher too. We all know that the pandemic caused an emotional run on real estate unlike any other. Housing prices are overheated, inventory is low and buyer confidence is falling. The reason prices are higher in San Francisco has to do with taxes and higher real estate prices.

Law of Supply and Demand

The home prices are tied to the supply and demand for housing. If there are fewer homes available, buyers will bid up the price in order to acquire one. If fewer buyers are looking for a property, the price will drop because buyers have fewer competition. Even before the pandemic, there was already a shortage of houses for sale. The pandemic only made it worse in a few ways. Homeowners migrating outside the city and situations like sellers nervous to show their homes. Hence, the pandemic has indeed affected the housing supply and demand.

The Silver Lining

Today’s low mortgage rates make home ownership cheaper. If you haven’t refinanced yet, now is your chance. Due to dropping mortgage rates, the cost of borrowing money to purchase a house is also dropping. Low rates can give a significant boost to your buying power. This can also generate larger returns on home investment, because the cost of ownership is lower relative to the value and potential sale price of the home.

Click here for more interesting articles!

Sign up for our mailing list!